Transforming Electric Motors

Business Model Description

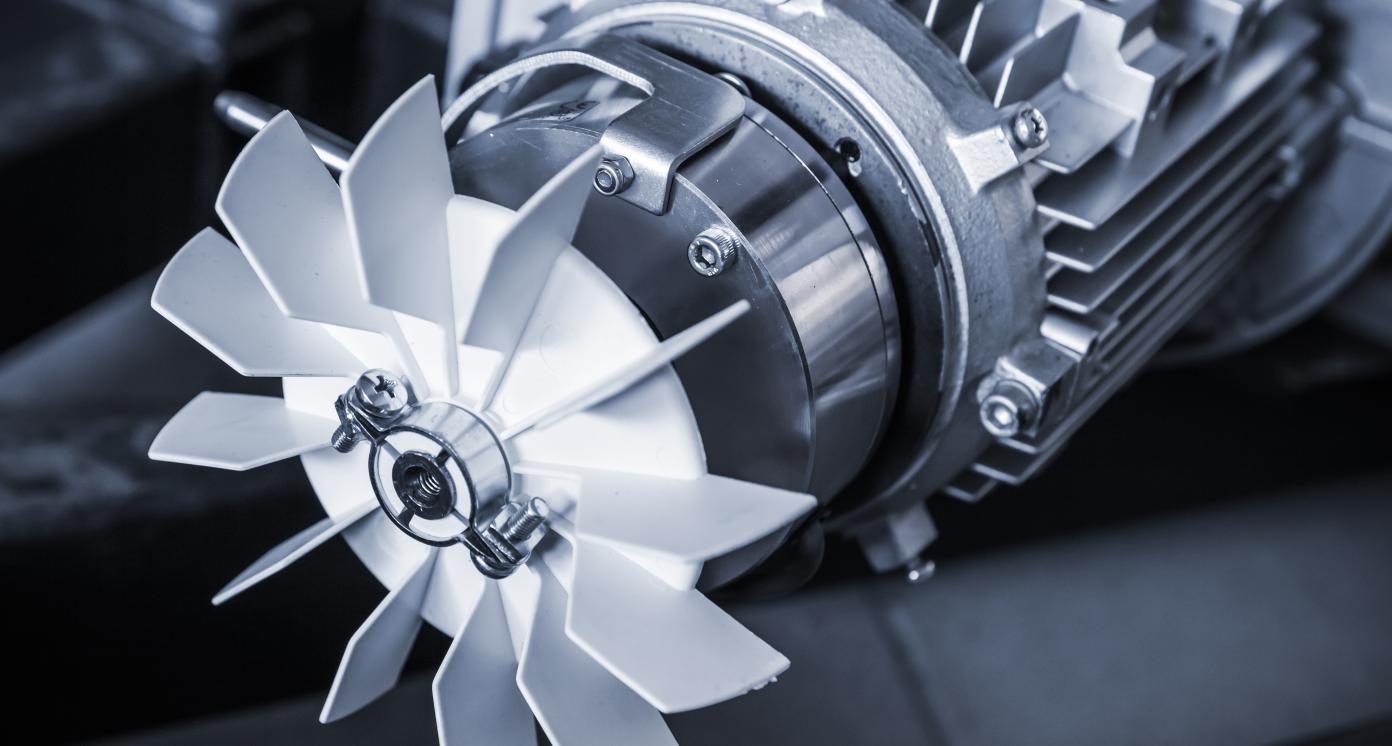

Transforming electric motors used in organized industrial regions to provide SMEs with energy-efficient motors.

Expected Impact

This IOA will contribute positively to energy efficiency in the manufacturing industry.

How is this information gathered?

Investment opportunities with potential to contribute to sustainable development are based on country-level SDG Investor Maps.

Disclaimer

UNDP, the Private Finance for the SDGs, and their affiliates (collectively “UNDP”) do not seek or solicit investment for programmes, projects, or opportunities described on this site (collectively “Programmes”) or any other Programmes, and nothing on this page should constitute a solicitation for investment. The actors listed on this site are not partners of UNDP, and their inclusion should not be construed as an endorsement or recommendation by UNDP for any relationship or investment.

The descriptions on this page are provided for informational purposes only. Only companies and enterprises that appear under the case study tab have been validated and vetted through UNDP programmes such as the Growth Stage Impact Ventures (GSIV), Business Call to Action (BCtA), or through other UN agencies. Even then, under no circumstances should their appearance on this website be construed as an endorsement for any relationship or investment. UNDP assumes no liability for investment losses directly or indirectly resulting from recommendations made, implied, or inferred by its research. Likewise, UNDP assumes no claim to investment gains directly or indirectly resulting from trading profits, investment management, or advisory fees obtained by following investment recommendations made, implied, or inferred by its research.

Investment involves risk, and all investments should be made with the supervision of a professional investment manager or advisor. The materials on the website are not an offer to sell or a solicitation of an offer to buy any investment, security, or commodity, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction.

Country & Regions

- Turkey: Black Sea Region

- Turkey: Central Anatolia Region

- Turkey: Marmara Region

- Turkey: Southeastern Anatolia Region

Sector Classification

Renewable Resources and Alternative Energy

Development need

According to the Sustainable Development Report Dashboard 2020, significant challenges remain in Turkey's performance on SDG 7 (Affordable and Clean Energy). Major challenges remain in the country’s performance on SDG 13 (Climate Action); major challenges remain in particular with regards to CO2 emissions from energy and the effective carbon rate.

Policy priority

The 2020 Annual Presidential Program highlights that Turkey is an energy-dependent country with a growing electricity demand. It suggests that the import-dependency should be solved through switching to sustainable alternatives. The 11th Development Plan and the SDG VNR also address this goal of securing a stable supply of energy and reducing carbon emissions.

Gender inequalities and marginalization issues

Globally, female employment in the energy sector is around 22%, while the renewable energy sector employs about 32% women. Even within renewables, women’s participation in STEM jobs is far lower than in administrative jobs. (19) In the developing world, 1/7 people lack electricity, especially in rural areas. (20) Providing alternative energy options that are off-the-grid can increase the coverage rate of the rural population and provide cheaper alternatives.

Investment opportunities

Turkey ranks 5th in energy consumption in Europe. Yet, the country meets almost 73% of its energy requirements from external sources. Turkey has a great natural potential for solar, wind, and geothermal energy. It has a localization objective of obtaining 30% of energy from renewables by 2023. This area is largely privatized & supported by various government incentives (6).

Key bottlenecks

With its growing population and economy, Turkey has an increasing demand for energy. Although successful incentive mechanisms and regulatory changes have been adopted, they are mostly geared towards large-scale energy projects. Supporting small-scale renewable energy projects and renewable energy cooperatives in a way that is compatible with market conditions is essential.

Alternative Energy

Development need

In Turkey, 47.2% of total electricity consumption is represented by the manufacturing industry. A large amount of electric motors used in the Turkish industry is energy inefficient and there are 15 million working electric motors in the market. It is estimated that 70% of energy consumption in industry is by electric motor-driven systems (8).

Policy priority

The 11th Development Plan highlights the need to improve energy efficiency in the manufacturing industry.

Gender inequalities and marginalization issues

Globally, female employment in the energy sector is around 22%, while the renewable energy sector employs about 32% women. Even within renewables, women’s participation in STEM jobs is far lower than in administrative jobs. (19) In the developing world, 1/7 people lack electricity, especially in rural areas. (20) Providing alternative energy options that are off-the-grid can increase the coverage rate of the rural population and provide cheaper alternatives.

Investment opportunities

There are various credit support lines for investments in energy efficiency such as the EBRD Sustainable Energy Financing Facilities credit lines, Conversion of Inefficient Electric Motors Used in Industry Credit Interest Support Program, and support by the Credit Guarantee Fund for SMEs.

Key bottlenecks

With its growing population and economy, Turkey has an increasing demand for energy. Although successful incentive mechanisms and regulatory changes have been adopted, they are mostly geared towards large-scale energy projects. Supporting small-scale renewable energy projects and renewable energy cooperatives in a way that is compatible with market conditions is essential.

Pipeline Opportunity

Transforming Electric Motors

Transforming electric motors used in organized industrial regions to provide SMEs with energy-efficient motors.

Business Case

Market Size and Environment

Number of organized industrial zones

There are 325 organized industrial zones in 80 cities in Turkey, creating a sizable market for the transformation of electric motors in manufacturing.

Indicative Return

10% - 15%

Investors considering projects in energy efficiency in Turkey expect an IRR of 8-12% on average with a maximum of 20%.

Investment Timeframe

Medium Term (5–10 years)

It will take a minimum of five years for a domestic and self-sustaining energy-efficient electric motor market to develop (9).

Ticket Size

USD 1 million - USD 10 million

Market Risks & Scale Obstacles

Capital - CapEx Intensive

Market - Volatile

Impact Case

Sustainable Development Need

Motors in Turkey are highly energy-intensive, it is estimated that an average electric motor in Turkey consumes an amount of energy equal to its purchase cost in about 45-60 days (running for 8 hours in a single shift) (10).

A typical electric motor causes an energy cost of more than 50 times its purchase cost during its 20 years of service life. This means that energy efficiency plays an extremely important role in the decision on which motor to purchase (10).

Gender & Marginalisation

SMEs in Turkey account for 73.9 % of employment and 53.9 % of value-added. (21) Small entrepreneurs were heavily affected by COVID-19.

Expected Development Outcome

Contribute 8.5 billion TRY to the Turkish economy by changing inefficient motors with efficient ones (11).

Achieve 10 to 30% energy savings and reduced emission rates by decreasing the total energy use or by increasing the production rate per unit of energy used, which can be sustained by switching to energy-efficient motors in the industry. (12).

Gender & Marginalisation

Primary SDGs addressed

7.2.1 Renewable energy share in the total final energy consumption

7.3.1 Energy intensity measured in terms of primary energy and GDP

7.b.1 Installed renewable energy-generating capacity in developing countries (in watts per capita)

13.37%(13)(14)

0.82kWh/$ (14)

Not available

Around 51% (dashboard)(13)

The world average is 1.43kWh/$ (tracker)(13)

Not available

9.4.1 CO2 emission per unit of value added

0.26 kilograms per $ of GDP (14)

Not available

Secondary SDGs addressed

Directly impacted stakeholders

People

Gender inequality and/or marginalization

Planet

Corporates

Indirectly impacted stakeholders

People

Public sector

Outcome Risks

Transformation in the industry may cause energy disruptions as well as the struggle for conventional motor producers.

Impact Classification

What

Increased energy efficiency in industry

Who

The general public, SMEs, owners of industrial facilities and organized industrial sites: Reduced GHG emissions, increased energy security, lower costs of production

Risk

Medium Risk (The transformation costs might be too heavy for SMEs. Subsidy or incentive mechanisms need to be implemented to make this financially feasible for smaller entreprises).

Impact Thesis

This IOA will contribute positively to energy efficiency in the manufacturing industry.

Enabling Environment

Policy Environment

(11th Development Plan): The 11th Development Plan highlights the need to improve energy efficiency in the manufacturing industry. It declares that a subsidy mechanism will be established for the replacement of inefficient electric motors used in manufacturing with efficient alternatives.

(The Ministry of Industry and Technology's Strategic Plan of 2019-2023): The Ministry of Industry and Technology's Strategic Plan of 2019-2023 mentions the importance of digitally transforming the manufacturing industry and KOBIs as well as the necessity of energy efficiency measures.

(Sustainable Development Goals Evaluation Report): The Sustainable Development Goals Evaluation Report of the Directorate of Strategy and Budget highlights digital transformation and energy efficiency as important areas of action

Financial Environment

Financial incentives: EBRD Sustainable Energy Financing Facilities offers credit lines with technical assistance (17); Conversion of Inefficient Electric Motors Used in Industry Credit Interest Support Program; the Credit Guarantee Fund will be Supporting SMEs through grants (16)

Continuing financial incentives: ; The Technology and Innovation Fund provides grant support

Other incentives: UNDP Turkey initiated a project to promote investments in industrial energy efficiency by transforming the market for energy efficient motors used in SMEs.

Regulatory Environment

(Regulation): 5627 Turkish Energy Efficiency Law: The energy efficiency law has been published in the Official Gazette in Turkey on 2 May 2007 (15) It lays down the principles and procedures to promote energy efficiency in the energy generation, transmission, distribution and consumption phases at industrial establishments, buildings, power generation plants, transmission and distribution networks and transport

(Regulation): Declaration on the Requirements for the Eco-Conscious Design of Electric Motors, 7 February 2012, Official Gazette #28197 sets out the design principles of sustainable electric motors

(Regulation): Turkish Standards Institute, TS EN 60034-30-1, Rotating Electric Machines- Section 30-1: Standard Categories for a.a motors powered by the grid (IE codes) delineates the efficiency categories of electric motors and lays down quality standards

Marketplace Participants

Private Sector

ARÇELİK, GAMAK, VOLT, AEMOT and other such large scale manufacturers

Government

Industry and Efficiency Department under the Ministry of Industry and Technology of Turkey, İl Bank

Multilaterals

EBRD, World Bank, IFC, UNDP Turkey

Non-Profit

Energy Efficiency Association (Enerji Verimliliği Derneği), Previously GEF Trust Fund

Target Locations

Turkey: Black Sea Region

Turkey: Central Anatolia Region

Turkey: Marmara Region

Turkey: Southeastern Anatolia Region

References

- (1) Sustainable Development Report Dashboard 2020, OECD Members, Turkey, https://dashboards.sdgindex.org/?fbclid=IwAR1tzYVKRXvPD2mwfvhf-mLTGGQEjA76y_HlrprWhSzNYZcqrLZMLXzRIcI#/TUR

- (2) 2020 Annual Presidential Program, http://www.sbb.gov.tr/wp-content/uploads/2019/11/2020_Yili_Cumhurbaskanligi_Yillik_Programi.pdf

- (3) 11th Development Plan http://www.sbb.gov.tr/wp-content/uploads/2020/03/On_BirinciPLan_ingilizce_SonBaski.pdf

- (4) Sustainable Development Goals Evaluation Report, http://www.surdurulebilirkalkinma.gov.tr/wp-content/uploads/2020/03/Surdurulebilir-Kalkinma-Amaclari-Degerlendirme-Raporu_13_12_2019-WEB.pdf

- (5) Ministry of Energy and Natural Resources 2019-2023 Strategic Plan, http://www.sp.gov.tr/upload/xSPStratejikPlan/files/LBigi+ENERJI_VE_TABII_KAYNAKLAR_BAKANLIGI_2019-2023_STRATEJIK_PLANI.pdf

- (6) Investment Office, 2020, https://www.invest.gov.tr/en/sectors/pages/energy.aspx

- (7) The National Strategy for Regional Development https://www.resmigazete.gov.tr/eskiler/2015/03/20150324M1-1-1.pdf

- (8) United Nations Development Programme Turkey, 2019, https://www.tr.undp.org/content/turkey/tr/home/presscenter/articles/2019/03/enerji-verimli-motor-kullan--enerjine-sahip-ck-.html

- (9) EMOSAD, Electronic Motors Industry. http://www.evf.gov.tr/content/files/Konusmaci_Sunumlari/turk-konusmacilar/%C4%B0brahim_Y%C4%B1ld%C4%B1r%C4%B1m_ElektrikMotorlariSektorSunumu.pdf

- (10) United Nations Development Programme Turkey, https://www.tr.undp.org/content/turkey/en/home/projects/promoting-energy-efficient-motors-in-small-and-medium-sized-ente.html

- (11) United Nations Development Programme Turkey, 2019, https://www.tr.undp.org/content/turkey/tr/home/presscenter/articles/2019/03/enerji-verimli-motor-kullan--enerjine-sahip-ck-.html

- (12) CTCN, Energy-efficient motors. https://www.ctc-n.org/technologies/energy-efficient-motors

- (13) SDG Index & Dashboard, 2020, https://dashboards.sdgindex.org/profiles/TUR/indicators

- (14) SDG Tracker, 2020, https://sdg-tracker.org/

- (15) Official Gazette, Enerji Verimliliği Kanunu. https://www.resmigazete.gov.tr/eskiler/2007/05/20070502-2.htm

- (16) KOSGEB, https://www.kosgeb.gov.tr/site/tr/genel/detay/5676/sanayide-kullanilan-verimsiz-elektrik-motorlarinin-donusumu-kredi-faiz-destegi-programi-basladi

- (17) EBRD, Sustainable Energy Financing Facilities. https://www.ebrd.com/downloads/research/factsheets/seff.pdf

- (18) IEA, Energy Efficiency Policy Opportunities for Electric Motor-Driven Systems. https://www.iea.org/reports/energy-efficiency-policy-opportunities-for-electric-motor-driven-systems

- (19) IRENA, Renewable Energy: A Gender Perspective, 2019, https://www.irena.org/publications/2019/Jan/Renewable-Energy-A-Gender-Perspective

- (20) UNDP Turkey, SDG 7, https://www.tr.undp.org/content/turkey/en/home/sustainable-development-goals/goal-7-affordable-and-clean-energy.html

- (21) European Commission, 2019, https://ec.europa.eu/neighbourhood-enlargement/sites/near/files/sba-fs-2019_turkey.pdf

- (22) Ministry of Industry and Technology of Turkey, 2020. https://www.sanayi.gov.tr/sanayi-bolgeleri/organize-sanayi-bolgeleri-hizmetleri/sf0303010609